Global economies & capital are stretched to wit’s end trying to make sense of the evolving US-China trade war situation and even more trying to anticipate effects and quantum of collateral damage.

Uncle Sam pokes the Chinese dragon once again!

Around the same time last week, U.S. President Trump did what he does best – an economic shakedown – this time to its arch nemesis China. The United States communicated its decision to raise import tariffs from 10% to 25% on Chinese goods valued at a significant $200 billion. While this impacts almost 5,700 product categories, the move is also seen as an igniting spark to a trade-war flare.

Such a perception was almost immediately validated by the U.S. increasing the span to more product categories bringing the import value in question to nearly $300 billion.

Though the Chinese initially seemed positive on arriving at middle-ground through amicable discussions, things took a sharp turn as the U.S. resorted to pressure tactics. A media statement reported a U.S. spokesperson indicating the Whitehouse’s intent to gradually turn up the tariff heat on almost all Chinese goods. China has now warned the U.S of retaliatory tariffs if it continues to indulge in double-faced tactics – similar to the way it initiated negotiations while simultaneously cranking up the tariffs. The future of negotiations seems bleak as the U.S. maintains pressure by its latest move to impose restrictions on Chinese telecom giant Huawei.

The probability of Chinese retaliation cannot be underestimated. China has already taken its first retaliatory step by imposing tariffs on U.S. goods worth $60 billion apart from the earlier tariffs on goods worth $110 billion. Apart from this, Beijing has also warned Washington about qualitative retaliation which may impact US companies operating in China. This is perhaps just indicative of how far the Chinese are willing to walk to maintain its stronghold as a super-economy.

Is Uncle Sam really insulated against the fiery breath? Not so much.

While China started with just an indicative tariff retaliation amidst pressure tactics by Washington, it is worth wondering if the U.S. is actually as strong as it shows? Maybe not.

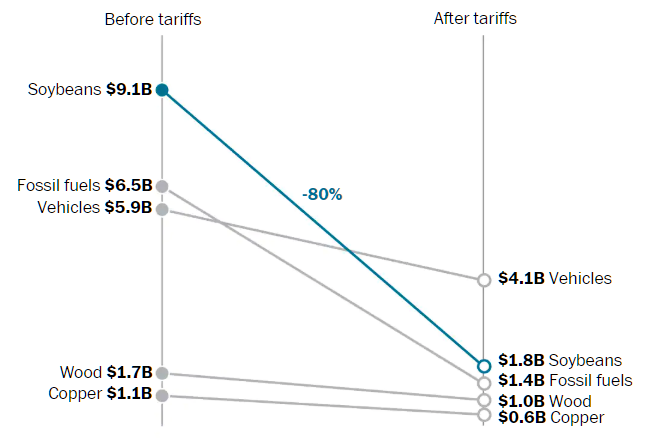

The targeted American industries including Soybeans, wood, copper and similar more are yet recuperating from the tariff burns imposed last year. Borrowing data from a compilation by The Washington Post, exports from the U.S. to China dropped by almost 26% (~$18.4 billion) in the six months ending March’19. While the slump was partially offset by other nations importing from the U.S., this serves as a precursor to anticipate the degree of impact a full-blown tariff war can have on the U.S. economy.

What is more interesting is China’s strategic targeting of its first round of tariffs on goods produced majorly in farm & manufacturing states including Michigan, Wisconsin, Texas, Iowa, Ohio and similar which were Trump’s key support regions during the 2016 elections.

Large industries were impacted heavily by China’s first round of tariff fire. The below illustration compares U.S. exports to China for the period of Oct’17-Mar’18 (Pre-tariff) & Oct’18-Mar’19 (Post-tariff).

Observed repercussions of the trade war has sparked global debates & controversies in an attempt to determine if the move that was made to protect and enrich American industries worked the way it was supposed to or is it just turning into a messy feud with no favorable outcome.

While economists & political analysts may debate all they want, the only thing definite is that war, in any form, has never been and will never be beneficial to the global economy.

Once Upon A Time: Here’s where it all began…

The infamous US-China tussle took real shape early last year when the U.S. slapped heavy tariffs on capital goods (aluminum & steel) imported from China. Situations escalated when the Whitehouse demanded that China reduces its $375 bill (trade deficit) with the U.S. while implementing verifiable measures for protecting intellectual property rights, transfer of technology & subsequently facilitate access for more American goods into China.

While controlling Chinese goods was a known yet muted point in Trump’s 2016 election campaign, major economies did not really expect it to materialize and especially balloon to this quantum; hence, catching many off-guard.

Will the heat scald India or offer warmth?

While tensions escalate among the two largest economies, Indian capital markets tumbled. However, it is noteworthy that this may just be spurious correlation given that India is rummaging around its own economic and political challenges.

Borrowing from a recent United Nations report, their study estimates that of the $250 billion in Chinese exports subject to US tariffs, about 82% will be captured by firms in other countries, about 12% will be retained by Chinese firms, and only about 6% captured by US firms.

Similarly, of the approximately $110 billion in US exports subject to China’s tariffs, about 85% will be captured by firms in other countries, US firms will retain less than 10%, while Chinese firms will capture only about 5%. The results are consistent across different sectors, from machinery to wood products, and furniture, communication equipment, chemicals to precision instruments.

Within the scheme of this trade rejig, India is placed in a rather comfortable situation as it gains a key position as a replacement import source for both U.S. & China economies. India stands to be the strongest beneficiary of the US-China tiff among emerging economies. Below is the UN’s analysis of economies standing to benefit as US & China seek substitutes to fill the gap.

Food for Thought: Is the trade war about something bigger than trade?

For long China has been developing a protected economy with barriers to foreigners & having significant capital & technology transfer as prerequisites to setting up shop in China. Beijing has been persistently defending such mercantilism by playing the “developing nation” card. However, times have evolved, and China stands strong as an economic superpower. China, today, possesses the wherewithal to threaten US’ positioning as a technology superpower on the back of rapidly increasing technology transfer & economic firepower (think about Trump demanding verifiable measures to protect technology transfer & intellectual property rights).

Also, just as a tangential question, isn’t the U.S. presidential election just around the corner in 2020 and Trump obviously wants to retain the Oval office?

If you have any concern, please write to us at ask@fisdom.com or call at +918048039999, we would be happy to answer your query.