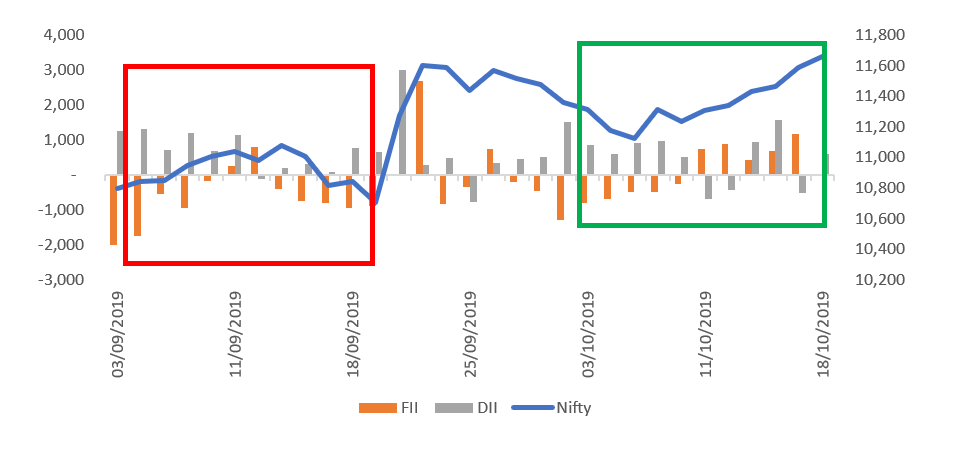

Appears that the bulls are back firmly this time – even the one residing abroad. FIIs retained their interest on the back of positive corporate earnings and perceived opportunity in the Indian market. We witnessed constant buying from FIIs this week, which remains the primary reason for sustenance in the uptick.

Key Happenings in the week that went by

Bumper opening for IRCTC:

IRCTC listed with a bumper gain of 100% and closed with an increase of 129%. This is so far the best gain of any PSU IPO and surpassed the 94% listing gain offered by Power Grid Corporation on its listing.

It implies the investors’ interest in the equity market and their bias towards quality and fundamental strength. From the government’s perspective, this precedent can be expected to aid further divestment measures.

What’s in for the investor here:

Strong divestment will help the government ease fiscal deficit which is expected to eventually translate to improved spending on infrastructure.

Strong corporate earnings

HUL Q2 profit increased 21% YoY to Rs 1,848 crore; announces Rs 11 dividend per share owned

Hindustan Unilever reported a net profit of INR.1,848 crore, a YoY rise of 21%.

If we will exclude the corporate tax benefit, the profit figure may come to ~INR.1,832 crore.

Country’s second-largest private sector bank HDFC bank has reported a YoY rise of 26.7% in net profit

Profit after tax for the quarter increased to INR.6,345 crore against INR.5,005 crore earned in the same period last year.

Reliance Industries posts record INR.11,262 crore profit in September quarter

Reliance Industries reported a net profit of INR.1,848 crore, a YoY rise of 18.35%. It became the country’s most valuable company after its market capitalization on market value touched INR.9 lakh crore. Notably, this is the only Indian company to achieve a market cap of such magnitude.

Possibilities of Brexit deal

Britain secured a Brexit deal with the European Union on Thursday, more than three years after the Brits voted to exit the bloc

The deal, however, needs final ratification of the British Parliament, which is a contingent event. Possibilities exist that if the deal may not get the parliamentary nod; in such a case the EU may extend the timeline.

Life ahead – at least in the near term

Indian equities are currently playing catch-up and the sentiment is likely to percolate to stressed sectors. Small and Midcaps are likely to witness buying interest. India’s two respected mammoths & index heavyweights – Reliance Industries and HDFC Bank’s quarterly results will set the ball rolling. Markets witnessed buying from FPIs and DIIs on improved sentiments and better prospects going ahead for the economy and we expect this uptick to sustain till the end of Christmas, at least.

Hence, investors may deploy fresh funds at current levels keeping in mind appropriate diversification and individual risk-taking abilities.

Key Mutual Fund News:

SEBI has accepted AMFI’s graded exit load recommendations for redemptions in liquid funds ; one day holdings would draw an exit-load of 0.007%, two days would lead to 0.0065%, three days would lead to 0.0060%, followed by 0.0055%, 0.0050%, 0.0045% till the sixth day; seventh day onwards there is no exit-load. This will be effective from the 20th of this month.